FSA & HSA Eligible

Shop eligible baby products using your pre-tax dollars and save the receipt to submit your claim to your benefits provider. Learn More

Shop by Guide

Frequently Asked Questions

What is FSA?

A Flexible Spending Account is an employer-provided benefit that allows users to save pre-tax dollars for use on eligible medical expenses. FSA contribution is committed during benefits enrollment and the entire amount is available to spend at the start of the year. FSA funds are ‘use it or lose it’ but offer the opportunity to roll over funds from one plan year to the next. Generally, funds placed in an FSA account can be used for eligible expenses incurred during a one-year period. Spending deadlines vary from plan to plan and should be confirmed with your benefits provider.

What is HSA?

A Health Savings Account is a type of savings account where users can contribute pre-tax dollars. A user must be enrolled in a High Deductible Health Plan to be eligible for an HSA account. Unlike an FSA these funds do not expire and roll over, growing tax-free over time.

What does ‘FSA & HSA eligible’ mean?

FSAs and HSAs can only be used for healthcare items that treat specific medical problems (as determined by the IRS in an annually updated list), so they won’t cover absolutely everything you need. But you might be surprised just how much you can get with your annual contributions—from everyday things like sunscreen to more expensive items like breast pumps!

What items are FSA &HSA eligible at Babylist?

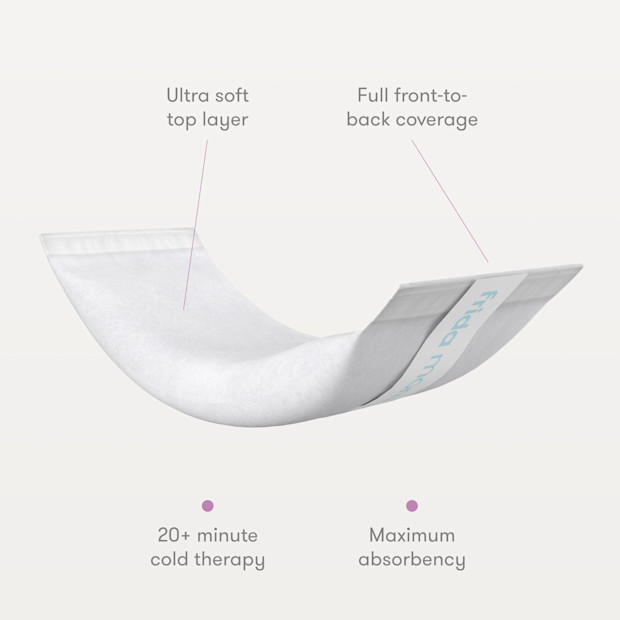

From baby monitors and nursing pads to prenatal vitamins and sunscreen, there are dozens of eligible items that can be purchased using your FSA/HSA funds. Check out our guide to discover the Baby Products You Can Purchase With HSA/FSA to learn more.

What types of items are not FSA & HSA eligible?

Before you go on a shopping spree with your spending account, here are some health necessities that are NOT FSA/HSA eligible:

- Diapers

- Wipes

- Teethers

- Toothbrushes

- Toothpaste

- Regular lotion—though eczema lotions are - - HSA/FSA eligible!

- Nail clippers

- Ginger candies for nausea

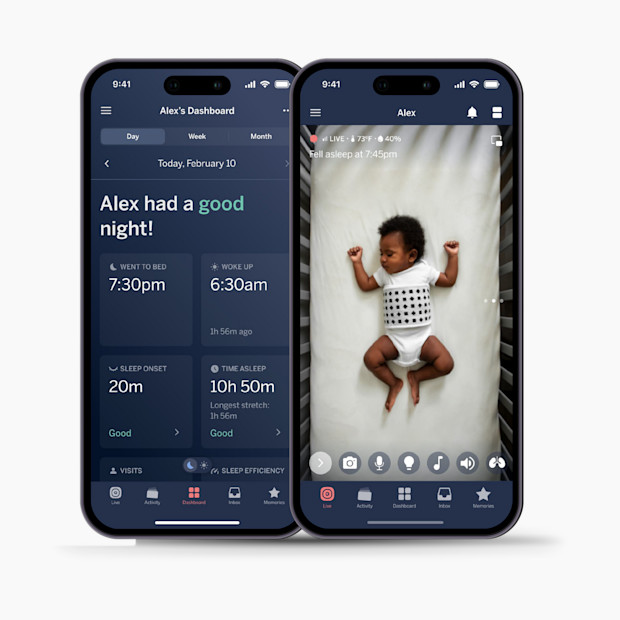

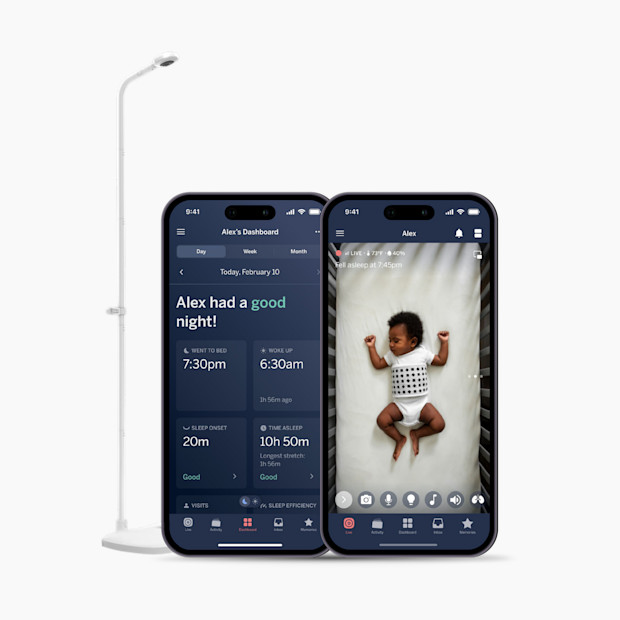

- Regular baby monitors—but any baby monitor that tracks health signs (breathing, oxygen, heart rate, etc), like Nanit or Owlet, is eligible!

- Nursing bras

For an item to qualify for FSA & HSA eligibility, it must fall under one of the IRS-approved eligible categories. This list is updated annually and may differ from the list above. Always check with your benefits provider for guidance on the eligibility of products.

Are vitamins FSA & HSA eligible?

Yes, prenatal vitamins are FSA/HSA eligible because they support the healthy development of babies before or during pregnancy. You can also use HSA/FSA money to soothe all pregnancy-related aches, including acid reflux, swollen ankles, and back and pelvic pain. Keep in mind that daily multivitamins and most dietary supplements are not currently eligible.

Are diapers FSA & HSA eligible?

No, diapers are not FSA & HSA eligible. However, diaper rash creams and baby rash ointment are eligible for reimbursement. Check out our list of Pregnancy and Baby Products You Can Purchase With HSA/FSA or visit FSAStore.com and Amazon’s HSA/FSA Shop to see which products are eligible.

Is sunscreen FSA & HSA eligible?

Yes, a variety of suncare products are FSA/HSA eligible including sunscreen and sunscreen lip balms.

What is FSA?

A Flexible Spending Account is an employer-provided benefit that allows users to save pre-tax dollars for use on eligible medical expenses. FSA contribution is committed during benefits enrollment and the entire amount is available to spend at the start of the year. FSA funds are ‘use it or lose it’ but offer the opportunity to roll over funds from one plan year to the next. Generally, funds placed in an FSA account can be used for eligible expenses incurred during a one-year period. Spending deadlines vary from plan to plan and should be confirmed with your benefits provider.

What is HSA?

A Health Savings Account is a type of savings account where users can contribute pre-tax dollars. A user must be enrolled in a High Deductible Health Plan to be eligible for an HSA account. Unlike an FSA these funds do not expire and roll over, growing tax-free over time.

Can You Use HSA/FSA to pay for pump parts?

If you need to pay for pump parts out of pocket, you might be able to use a Health Savings Account (HSA), Flexible Spending Account (FSA) or Health Reimbursement Account (HRA). Here’s a guide on how to use your HSA/FSA for replacement pump parts.